Repost from Reuters

UPDATE 2-Canadian province of Alberta leases 4,400 rail cars to clear oil glut

By Rod Nickel, February 19, 2019 / 12:06 PM![]() WINNIPEG, Manitoba, Feb 19 (Reuters) – Canada’s oil-producing province of Alberta has leased 4,400 rail cars in a multibillion-dollar move to clear a glut of crude that depressed prices, Premier Rachel Notley said on Tuesday.

WINNIPEG, Manitoba, Feb 19 (Reuters) – Canada’s oil-producing province of Alberta has leased 4,400 rail cars in a multibillion-dollar move to clear a glut of crude that depressed prices, Premier Rachel Notley said on Tuesday.

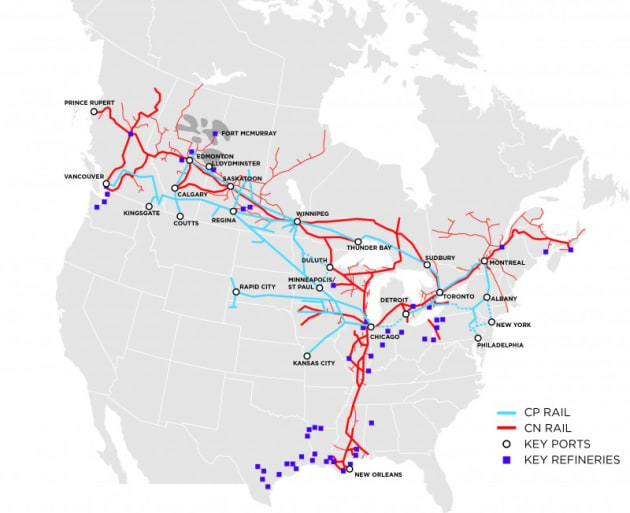

Notley said Alberta would start putting cars into service in July so it can buy and sell oil itself. Canadian National Railway Co and Canadian Pacific Railway Ltd will haul a combined initial volume of 20,000 barrels per day that will reach 120,000 bpd by mid-2020.

Alberta’s rail investment is part of a rescue package for an oil industry struggling with high costs and the exit of some foreign majors. Pipelines have become congested because of environmental opposition that has stymied expansion.

The provincial government took the rare step in January of ordering oil production cuts.

“Rather than produce less, we have to find ways to move more,” Notley said in Edmonton.

The three-year plan will cost Alberta C$3.7 billion ($2.80 billion), consisting of buying oil, leasing cars and purchasing rail and loading services. Alberta expects to earn gross revenues of C$5.9 billion ($4.5 billion) from reselling oil and higher royalties to produce net revenues of C$2.2 billion.

Shares of CN and CP gained nearly 1 percent in Toronto. CN expects to handle 60 percent of Alberta’s barrels, Chief Executive J.J. Ruest said in a statement.

The Alberta government said in November, when Canadian oil fetched near record-large discounts to U.S. oil, that it was seeking train capacity. It has also provided incentives for petrochemical and partial-upgrading plants.

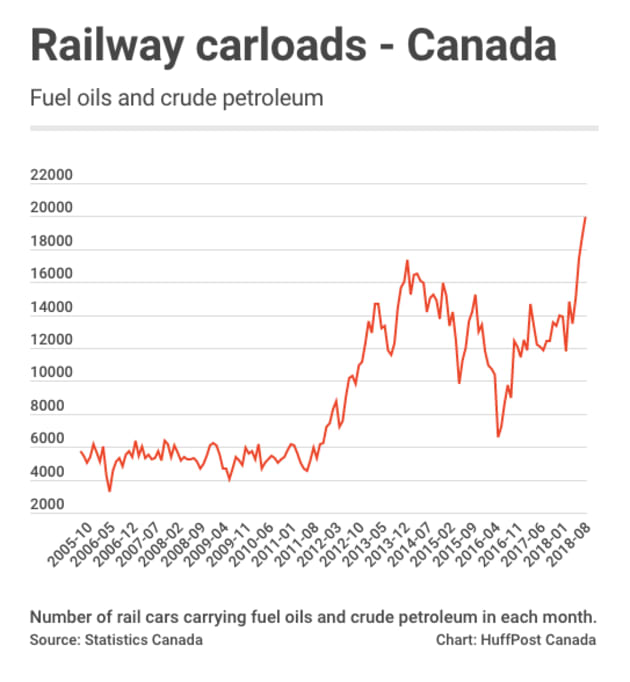

Canadian crude-by-rail volumes hit record highs last year, but declined in 2019 after production cuts made rail shipments less economic. Imperial Oil said it was forced to cut its own rail shipments to “near zero,” illustrating the potential for unintended consequences when governments intervene.

Economic conditions were already improving for rail shipments, Notley said.

Rail shipments are seen as a relief valve for oil when pipelines are full, but they are generally more expensive and less safe. A CN oil train derailed on Saturday in Manitoba.

Notley’s New Democratic Party government faces a stiff spring election challenge from the United Conservative Party (UCP). UCP energy critic Prasad Panda said the party was reviewing the rail plan.

Three-quarters of the cars will be the DOT-117J model, featuring thicker steel than some types. The rest will be DOT-117R cars retrofitted to meet some DOT-117J standards, but a type that BNSF Railway Co is phasing out after a derailment in Iowa last year. ($1 = 1.3205 Canadian dollars)

(Reporting by Rod Nickel in Winnipeg, Manitoba; Editing by Chizu Nomiyama and Peter Cooney)

You must be logged in to post a comment.